.jpg)

Secondary markets plateau in October according to ApeVue

ApeVue's October analysis shows that the private market slump in 2022 is not over quite yet

November 7, 2022

October Market Recap:

After a tumultuous summer, many expected October to be a bounce-back month for private markets. Previously, we talked about record levels of “dry-powder” VC funds ready to be deployed to startups. This dry-powder buildup continues, as coordinated central bank rate increases and a large mindset shift from VC investors has slowed additional funding on late stage privates.

In 2022, startup valuations have continued to decrease significantly. This is due to a number of factors, including the slow down in the global economy, the rise in interest rates, and the increase in competition for capital. As a result, many startup companies will be forced to scale back their operations or even shut down entirely. The decrease in startup valuations will have a ripple effect on the startup ecosystem, as investors and founders alike will be forced to re-evaluate their portfolios and strategies

As this shift from pure growth to cash conservation and profitability has taken effect, companies that benefited from massive valuations in previous years will likely need to make a decision as they seek more funding. Fast-track to IPO, taking a down round, debt financing, or some sort of acquisition or buyout are all potential options. While the largest example of a down round is the well known Klarna, which we covered previously, other unicorns have yet to follow suit.

ApeVue 50 October Performance Review:

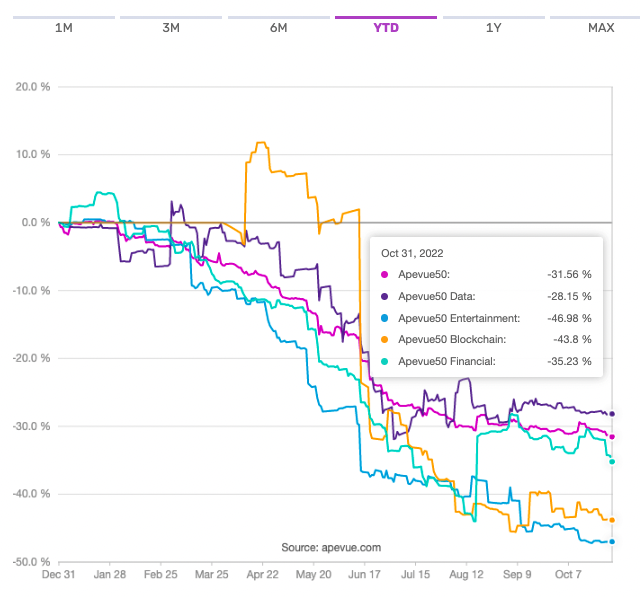

As of October 31st, the ApeVue 50 was down -31.56% YTD, with the month by itself bringing a -1.24% decrease. While the benchmark index is down considerably on the year, October has shown a continued plateau compared to the steep drops in previous months.

ApeVue 50 Entertainment subsector has shown the greatest decline in 2022, sitting at -46.98% YTD. Data has shown resilience in comparison, beating the ApeVue 50 but still down to -28.15% as of Oct. 31st.

Top Names Oct. Performance - Based on ApeVue Composite Prices (Sept. 30 & Oct. 31)

Epic Games: -0.48%

Stripe: -2.68%

Revolut: -4.41%

Klarna: -5.34%

Flexport: -5.61%

ConsenSys: -12.85%

Arctic Wolf: -0.33%

SpaceX: -4.28%

Bytedance: -1.94%

Executive Exodus: Blockchain and Web3 Companies

What do Celcius, FTX, and Kraken all have in common? If you answered that they are all crypto-focused private companies, you are only partially correct. All three of the firms announced major news in the past few weeks of executive departures. The exodus of leadership at these firms could be telling of a number of factors, including increased regulatory scrutiny and shrinking retail interest in crypto as many investors were left burned in 2022 thus far.

Alex Mashinsky, CEO of Celcius, crypto lending firm, has stepped down following the firms bankruptcy filing in July. Brett Harrison, President of FTX US also announced his departure from the firm, for unknown reasons. Jesse Powell, CEO of Kraken is the third major departure from unicorn blockchain firms, amid much controversy, including an investigation by the US Treasury Department, and reports of toxic workplace environment based on internal messages from Powell himself.

OpenSea, the NFT Marketplace, has struggled as well. Laying off 20% of employees in July, ApeVue’s composite price based on secondary market activity shows the share price taking a 23.16% decline in September. Also reported recently is NFT trading volume down 97% from Jan ‘22 highs as reported by Bloomberg.

While many executives claim that this “crypto winter” is exacerbated by the macroeconomic environment, time will tell if VC’s will continue to invest in private blockchain companies, and ApeVue will continue to monitor their trading performance on the secondary market.

www.apevue.com

Twitter: @vueape

LinkedIn: www.linkedin.com/company/apevue/

Contact: contact@apevue.com

Ready to see it in action?

Schedule a demo with one of our experts

.png)

.png)

.png)

.png)

.png)

-min%20(2)%20(1).png)