ApeVue: 2022 Year in Review

Private markets struggle in 2022 - ApeVue Annual Review

January 6, 2023

2022 was a pivotal year in private markets. Some may refer to it as the "great valuation reckoning," where, after a decade of low interest rates and easy access to capital, the valuations of private companies skyrocketed to astronomical numbers.

This came to an abrupt halt in 2022, as firms of all sizes immediately shifted from a focus on growth at any cost to capital savings and preparation for turbulent economic conditions. In addition, the IPO market cooled significantly in 2022, which required firms that were potentially preparing a public offering to table these plans for later. As investors became more hesitant to give out large checks, private firms needed to extend their runway as liquidity events and access to more capital became scarce.

While transaction volume did drop, 2022 was an important year for secondary markets. An increase in awareness of the secondary market among late-stage private companies brought new firms into this market. It provided a liquidity venue for those looking to exit, allowing new investors to join the cap table who would otherwise be unable to, due to a lack of primary rounds.

The valuation markdowns can be argued to indicate that many companies were simply overvalued, but this year also provided a good buying opportunity for those looking to take advantage of lower prices and barriers to entry into many private firms.

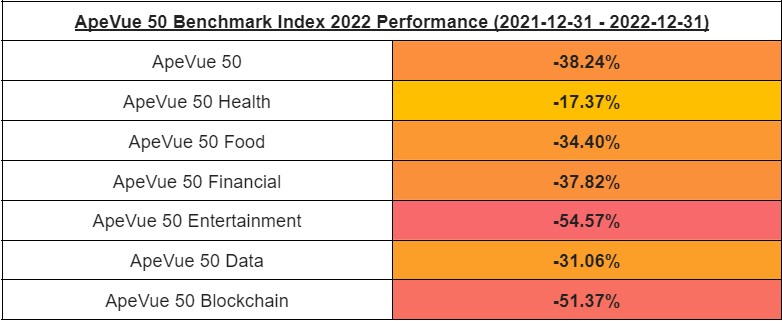

In comparison to 2021, the ApeVue50, the industry standard benchmark for late-stage private markets, was down. We observed the private markets move lower with the public markets, albeit with a slight lag. On Dec. 31 2022, the AV50 ended the year at -38.24%. The ApeVue sub-sectors saw varying performance, the worst performing being Entertainment (-54.67%), followed by Blockchain (-51.37%).

ApeVue 50 vs. Broad Market Indices 2022 Performance

There were many significant events across all sectors in 2022. In the DeFi/Crypto space, we saw the “crypto winter” hit hard with both digital asset prices falling and as the recent meltdowns of firms such as FTX and Cescius.

Elon Musk saw increased media attention & scrutiny with his purchase of Twitter and bringing the company private, but SpaceX, his aerospace firm, was seemingly untouched by the broader market downturns this year and finished up 30.55% and leading the AV50 in returns.

Among the hardest hit private sectors were payments and BNPL (buy now, pay later), with names such as Klarna (-83.60%) and Stripe (-65.33%) seeing double digit losses.

While the private sector has been impacted by the global market downturn, investor enthusiasm and interest in private assets has not waned. According to Decibel Partners as of September 2022, VC firms are sitting on over $290B of capital (known as “dry-powder”) ready to deploy into new companies.

Will 2023 bring a rebound for late-stage private stocks? Time will tell! Follow along with ApeVue in 2023 as we track private markets, providing unparalleled independent data and insights.

LinkedIn: ApeVue

Twitter: @vueape

Ready to see it in action?

Schedule a demo with one of our experts

.png)

.png)

.png)

.png)

.png)

-min%20(2)%20(1).png)